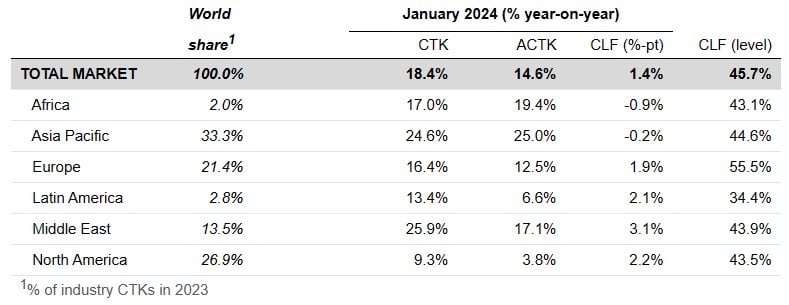

According to figures issued by the International Air Transport Association (IATA) for the gloabal air cargo markets in January 2024, the year is off to a great start. Compared to January 2023 levels, the total demand, expressed in cargo tonne-kilometres (CTKs), rose by 18.4% (19.8% for international operations). Since the summer of 2021, the annual growth in cargo tonne-kilometres has not been this high until this notable upturn.

Available cargo tonne-kilometres (ACTKs), a measure of capacity, increased by 14.6% from January 2023 to that same month (18.2% for international operations). This had a lot to do with the expansion of belly capacity. According to YoY data, international cargo capacity increased by 25.8% due to the strength of the passenger markets.

"Air cargo demand was up 18.4% year-on-year in January. This is a strong start to the year. In particular, the booming e-commerce sector is continuing to help air cargo demand to trend above growth in both trade and production since the last quarter of 2023. The counterweight to this good news is uncertainty over how China’s economic slowdown will unfold. This will be on the minds of air cargo executives meeting in Hong Kong next week for the IATA World Cargo Symposium with an agenda focused on digitalization, efficiency and sustainability," says Willie Walsh, Iata’s director general.

Air cargo growth outpaces trade and production

Several factors in the operating environment should be noted:

In December, global cross-border trade increased by 1.0% compared to the previous month (-0.2% year-on-year). For the first time in eight months, the manufacturing output Purchasing Managers' Index (PMI) increased to 50.3, above the 50 threshold in January, suggesting expansion. The PMI for new export orders increased to 48.8, although it is still below the crucial 50 level, indicating that global exports are still declining but are doing so more slowly.

According to the Consumer Price Index (CPI), inflation in the main economies has continued to decline, with the US and EU experiencing 3.1% and Japan a 2.1% inflation respectively. On the other hand, China's CPI showed deflation for the fourth straight month, stoking worries about a slowdown in the country's economy. With an inflation rate of -0.8%, China has its lowest level of inflation since the 2009 Global Financial Crisis.

Air cargo market

January regional performance

Asia-Pacific airlines saw their air cargo volumes increase by 24.6% in January 2024 compared to the same month in 2023. This performance was above the previous month (+18.5%). Carriers in the region benefited from ongoing growth in international CTKs on three major trade lanes: Africa-Asia (+52.5%), Middle East-Asia (+29.5%), and Europe-Asia (+27.5%). Available capacity for the region’s airlines increased by 25.0% compared to January 2023 as more belly capacity came online from the passenger side of the business.

North American carriers had the weakest performance of all regions in January, with a 9.3% increase (YoY) in cargo volumes. This was a performance improvement compared to December (2.0%). Carriers in the region benefitted from growth on the North America-Asia trade lane (+17.1%) and the North America-Europe trade lane (+3.5%). Capacity increased by 3.8% compared to January 2023.

European carriers saw their air cargo volumes increase by 16.4% in January compared to the same month in 2023. This was a stronger performance than in December (+8.6%). Carriers in the region benefitted from the strong growth in international CTKs in the Europe market (+18.4%) and the Europe-Asia route (+27.5%). Gains made from the significant expansion in the Middle East-Europe trade lane (+46.1%) also benefited carriers in the region. Capacity increased 12.5% in January 2024 compared to the same month in 2023.

Middle Eastern carriers had the strongest performance in January 2024, with a 25.9% year-on-year increase in cargo volumes. This was a significant improvement from the previous month’s performance (+18.3%). Carriers in the region benefited from growth in the Middle East-Asia (+29.5%) and Middle East-Europe markets (+46.1%). Capacity increased by 17.1% compared to January 2023.

Latin American carriers experienced a 13.4% increase in cargo volumes compared to January 2023, a notable increase compared to the previous month’s gain (+6.4%). Capacity in January was up 6.6% compared to the same month in 2023.

African airlines saw their air cargo volumes increase by 17.0% in January 2024, much improved compared to December’s performance (-1.2%). Carriers in the region benefitted from strong growth on the Africa-Asia trade lane. Capacity in January was 19.4% above January 2023 levels.