Global economic prospects remain subdued and fraught with uncertainty, according to the latest Chief Economists Outlook released today, as the global economy continues to grapple with headwinds from tight financial conditions, geopolitical rifts and rapid advances in generative artificial intelligence (AI).

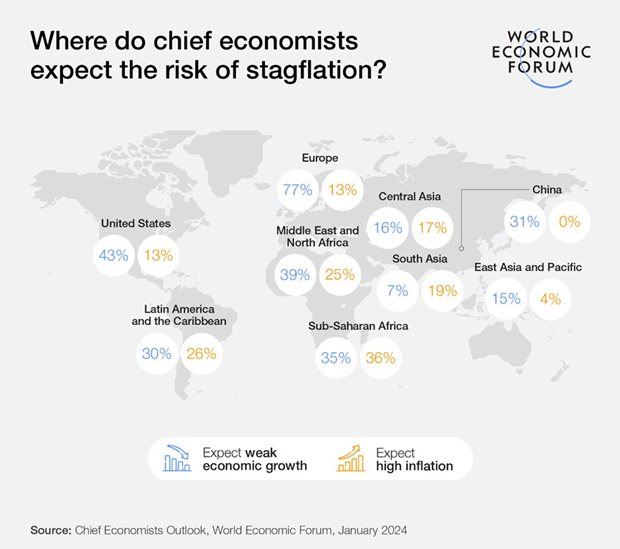

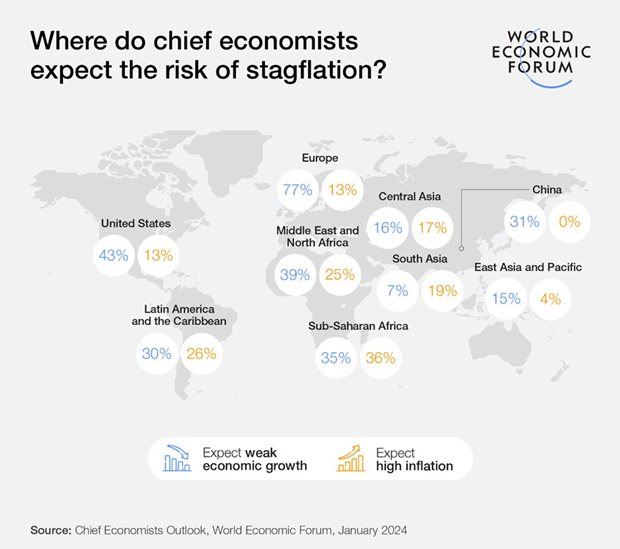

More than half of chief economists (56%) expect the global economy to weaken this year, while 43% foresee unchanged or stronger conditions. A strong majority also believe labour markets (77%) and financial conditions (70%) will loosen over the coming year. Although the expectations for high inflation have been pared back in all regions, regional growth outlooks vary widely and no region is slated for very strong growth in 2024.

“The latest Chief Economists Outlook highlights the precarious nature of the current economic environment,” said Saadia Zahidi, managing director, of the World Economic Forum. “Amid accelerating divergence, the resilience of the global economy will continue to be tested in the year ahead.

Though global inflation is easing, growth is stalling, financial conditions remain tight, global tensions are deepening and inequalities are rising – highlighting the urgent need for global co-operation to build momentum for sustainable, inclusive economic growth.”

Regional variations

The outlook for South Asia and East Asia and Pacific remains positive and broadly unchanged compared to the last survey, with a strong majority (93% and 86% respectively) expecting at least moderate growth in 2024. China is an exception, with a smaller majority (69%) expecting moderate growth as weak consumption, lower industrial production and property market concerns weigh on the prospects of a stronger rebound.

In Europe, the outlook has weakened significantly since the September 2023 survey, with the share of respondents expecting weak or very weak growth almost doubling to 77%. In the United States and the Middle East and North Africa, the outlook is weaker too, with about six in 10 respondents foreseeing moderate or stronger growth this year (down from 78% and 79% respectively). There is a notable uptick in growth expectations for Latin America and the Caribbean, sub-Saharan Africa and Central Asia, although the views remain for broadly moderate growth.

Source: Supplied.

Geopolitical rifts compound uncertainty

About seven in 10 chief economists expect the pace of geoeconomic fragmentation to accelerate this year, with a majority saying geopolitics will stoke volatility in the global economy (87%) and stock markets (80%), increase localisation (86%), strengthen geoeconomic blocs (80%) and widen the North-South divide (57%) in the next three years.

As governments increasingly experiment with industrial policy tools, experts are nearly unanimous in expecting these policies to remain largely unco-ordinated between countries. While two-thirds of chief economists expect industrial policies to enable the emergence of new economic growth hotspots and vital new industries, a majority also warn of rising fiscal strains (79%) and divergence between higher- and lower-income economies (66%).

AI takes the spotlight

Chief economists expect AI-enabled benefits to vary widely across income groups, with notably more optimistic views about the effects in high-income economies. A strong majority said generative AI will increase efficiency of output production (79%) and innovation (74%) in high-income economies this year. Looking at the next five years, 94% expect these productivity benefits to become economically significant in high-income economies, compared to only 53% for low-income economies.

Almost three-quarters (73%) do not foresee net-positive impact on employment in low-income economies and 47% said the same for high-income economies. The views are somewhat more divided on the likelihood of generative AI to increase standards of living and to lead to a decline in trust, with both being slightly more likely in high-income markets.