Stock market volatility, as measured by the VIX index for the S&P 500, recently reached the highest level since the Covid-19 pandemic, five years ago. Meanwhile, global government bond yields are rising sharply as markets digest rapidly increasing sovereign debt ratios.

Source: Supplied. Mark Gibson, Senior Investment Director ILS at Schroders.

Schroders has warned before of the unintentional risks for investors who do not make deliberate, active choices in a world that has become geopolitically and economically much more uncertain.

We have also championed the benefits of portfolio diversification, to enhance downside protection, bring potential return opportunities, and, importantly in the current climate, gain exposure to alternative sources of income.

In this context, it is worth considering the potential benefits of insurance-linked securities as a valuable (and perhaps the only truly) uncorrelated source of income within a diversified portfolio – and one that has generated exceptional performance over both recent years, and the longer term.

What are insurance-linked securities?

For the uninitiated, insurance-linked securities are a form of protection bought primarily by reinsurers, but also some corporations and public entities, against the risks associated with specific, catastrophic natural events, for example hurricanes.

The best-known part of the market is catastrophe bonds, or “cat” bonds, which are conventionally tradeable securities that have a three to five-year lifespan. There are also a wide range of privately agreed, non-tradeable securities contracts that have shorter lifespans and provide exposure to a wider range of insurance risks.

In all cases, the securities are issued by special purpose vehicles, into which capital provided by the end investors in the securities is paid. Those vehicles are backed by a collateral account funded by the proceeds from the issuance – and which in turn invest in low-risk instruments such as money-market funds that supplement the income yield paid to investors from the underlying insurance premium.

The structure means that reinsurers are covered in the event that the insured event occurs – and investors are not exposed to credit risk of either the reinsurer or the issuer, as the capital that would be used to meet payouts is held separately in a trust account.

How insurance-linked securities are structured

Source: Schroders Capital, March 2025. Proceeds include from share or bond issuance. Return and payouts include return on collateral, collateral return to investors at maturity, and/or collateral to cover loss payments. Coupon is made up of risk premium + return on collateral.

Attractive yields

Taking a look at the recent numbers, the Swiss Re Global Cat Bond index, which is the key reference point for the publicly listed bonds that are the most well known part of the asset class, was up 17.3% in 2024 and 19.7% in 2023. Both of these were record years, so it is fair to characterise them as outliers.

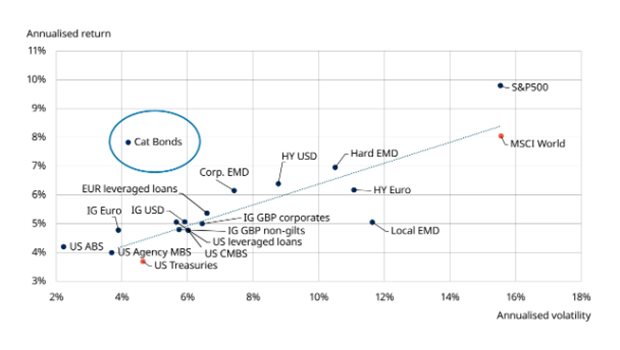

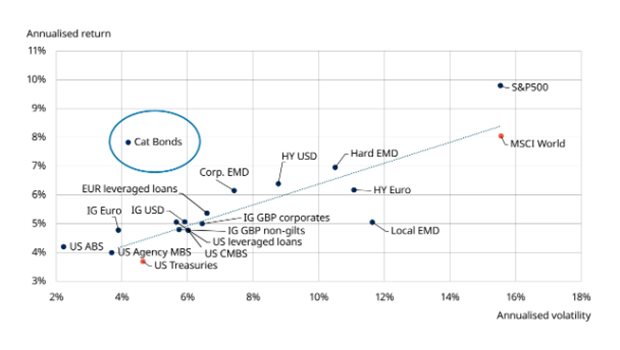

However, since the index was launched in 2002, cat bonds have generated overall performance that has beaten every asset class with the exception of global equities in terms of annualised returns.

Fundamentally, therefore, the asset class has generated returns equivalent to investments that entail much higher levels of volatility (see chart). This reflects the nature of the risks involved; the higher coupon rates typically available are designed to compensate investors for taking on insurance risk related to low probability, but high severity, events.

Cat bonds vs other asset classes since 2002x

Source: Bloomberg, Swiss Re, Schroders Capital. Data from 31 December 2001 to 31 January 2025. Cat bonds: Swiss Re Global Cat Bond TR Index, Global Equities Developed: MSCI World, High yield bonds: BofA Merrill Lynch Global High Yield Index, Emerging Markets Debt: JP Morgan EMBI+, Commodities: S&P GSCI, Investment grade bonds: Bloomberg US Corporate Bond Index, US Treasuries: BofA Merrill Lynch US Treasury, Hedge Funds: Credit Suisse Hedge Fund Index. Cat bonds positive if index negative refers to monthly performance of Swiss Re Global Cat Bond Index vs. other indices. Worst month figure refers to the Swiss Re Global Cat Bond Index, which suffered the biggest draw-down over all cat bond indices in September 2022 from Hurricane Ian. Insurance-linked instruments are particularly exposed to sudden substantial or total loss due to natural and/or man-made catastrophes. Diversification cannot ensure profits or protect against loss of principal.

Turning back to the strong returns over the past two years, these came on the back of a decline in 2022, of 2.2% - the first negative year in the history of the asset class. This in turn was the result of significant losses in the latter part of the year on the back of a particularly devastating hurricane season in the US.

The rebound since then highlights one other facet of the asset class – its recovery from moments of decline, which is often swift and strong, reflects the nature of the reinsurance market that underpins it.

In short, when a low-probability but high-severity event happens, reinsurers will face payouts and take immediate – in some cases, significant – losses. In response, and as a core mechanism of the market, reinsurers will reprice the risks they are underwriting, increasing premiums and widening spreads. That re-pricing feeds into the yields offered to the investors in insurance-linked securities that are sold to finance potential payouts.

Uncorrelated returns

But the potential returns from insurance-linked securities are not the main appeal of the asset class. Yes, performance has been strong – but the fact that these returns are uncorrelated to wider capital markets is the biggest benefit from a portfolio perspective.

Put simply, insurance-linked securities are exposed solely to natural, often weather-related, risks. Those risks are unaffected by geopolitical events, economic fluctuations, or shifts in sentiment on capital markets more broadly. That is particularly attractive in the current climate, in which political shifts are driving severe market undulations, especially for listed equities.

To show how this has played out historically, catastrophe bonds earned a positive return when the financial world was crashing during the Great Financial Crisis in 2008, while in 2020 the asset class was almost entirely untouched by the Covid-19 pandemic. Even in 2022, the losses were well below those seen on both equities and fixed income markets, which both recorded negative annual returns for the first time in half a century.

Annualised return and volatility since January 1997, or inception

Past performance is not a guide to future performance and may not be repeated. Source: Schroders, LSEG Datastream, ICE Data Indices, J.P. Morgan, Credit Suisse. Data as at 30 November 2024. All return and volatility figures shown as USD hedged, except EMD Local and MSCI World which are unhedged returns in USD.

In the context of fixed income, another notable way that insurance-linked securities are uncorrelated is in relation to duration; that is, the sensitivity to interest rate changes over time.

That’s because the bulk of the return in the coupon paid to investors is made up of the fixed insurance premium, with only the collateral, money market-based return being floating rate. This in turn means shifts in monetary policy have minimal impact on the yield to investors.

Furthermore, risk periods on these securities typically range from six to 36 months, meaning a portfolio will have a blend of short-term durations exposures that are not subject to the longer tail of the yield curve.

Insurance-linked securities in a volatile market

In a world that has become decidedly more volatile, insurance-linked securities could be an interesting option for investors. Beyond the attractive yield and returns in recent years, their key appeal lies in being uncorrelated to market and geopolitical risks, meaning they represent a potentially valuable source of income diversification and portfolio resilience.