The Ctrack Transport and Freight Index (Ctrack TFI) declined for eight consecutive months to reach an index level of 112.8 in January 2025, the lowest since December 2022 and a declining streak resembling the strain experienced amid the Covid-19 pandemic, when the economy sagged into a deep recession.

At this level the index is 5.0% below a year earlier and a notable 10.1% below the May 2024 print of 126.5, suggesting a significant U-turn in the latter months of 2024. The weakness in the logistics sector has been quite broad-based during 2024, resulting in the sector subtracting from overall economic growth. This is quite a disappointing performance as the transport sector has often in the past been an outperformer relative to the broader economy, but that trend had changed abruptly.

For calendar year 2024, three sub-sectors contracted with the heavy-weighted road freight sub-sector leading the way with a contraction of 2.8%, see graph 2. Transport via pipelines contracted for a second consecutive year, by 1.8% in 2024 (-1.0% in 2023), while the sub-component for storage and handling contracted for a third consecutive year. The air freight sector turned out to be the star performer in 2024, growing by 10.5%, while the rail freight and sea freight sectors grew by 3.9% and 3.4%, respectively. The further monthly decline in the Ctrack TFI in January 2025 suggests that the sector remains on the backfoot entering 2025.

The heavily weighted Road Freight sub-sector, which has grown notably in recent years and currently accounts for 83.1% of all freight payload in South Africa (down from 84.4% in 2023), contracted notably in 2024 – see graph 3. Following on growth of 1.5% in 2023, road freight payload in South Africa plummeted in 2024, with a drop of 8.3%. While the ongoing weakness in the South African economy has been a factor in this disappointing performance of the road freight sector (though economic growth on average was at similar levels in 2024 compared to 2023), other challenges have probably played a bigger role.

These include the redirection of cargo ships towards other ports in Africa, especially in time periods when Durban port’s terminals are plagued by inefficiencies, resulting in less demand for heavy vehicle transport in South Africa. As an illustration, the number of heavy trucks (class 3 and 4) passing through the Tugela Toll Plaza on the N3 route dropped by 1.0% in 2024, compared to growth of 0.5% in 2023. Similarly, heavy vehicle traffic on the N4 route towards Maputo port also contracted in 2024, following on notable growth in the preceding two years. The political unrest following elections in Mozambique played a notable role in the decline in road freight transport on the N4 route.

The efficiency of our maritime gateways is critical not only for the success of the freight industry, but for the entire supply chain. Ongoing challenges at our ports have highlighted the urgent need for modernisation, increased capacity, and improved management.

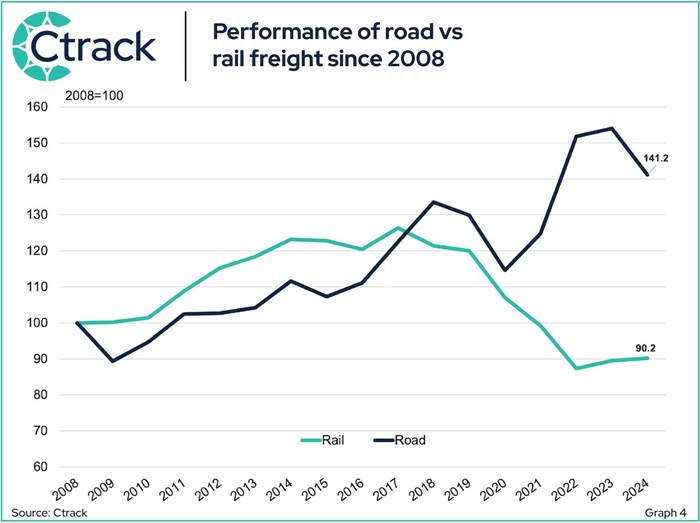

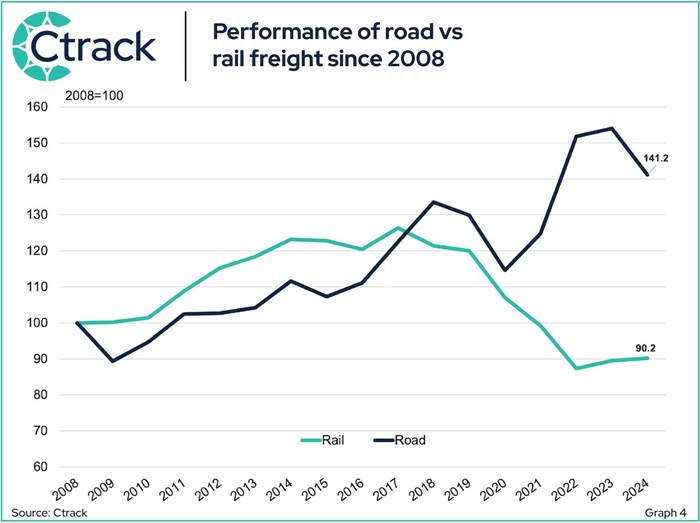

While momentum moderated somewhat in 2024, the recovery in the Rail Freight sector is still on track and likely to see more cargoes moving from road to rail in coming years. However, this is a very slow-moving trend and not the main driver of slack in the road freight sector in 2024 (it is in actual fact a minor factor in the road freight under-performance in 2024). Rail freight payload in South Africa increased only marginally in 2024, with an increase of 0.8% in 2024 vs 2.4% in 2023. Still, these two years represent a hesitant, but welcome turnaround in the rail freight space after five consecutive years of contraction (2018 to 2022).

From reaching a rock-bottom low of only 10.3% of total freight payload been transport via rail in November 2022, the performance of rail has improved to 17.8% in December 2024 (full year 2024: 16.9% vs 15.6% for 2023), though still notably lower than the 10-year average of 25.9% (rail freight to total payload in 2008-2017) prior to the onset of the significant deterioration.

The rail freight sector remains a top priority in government’s structural reform initiatives, as outlined in the Freight Logistics Roadmap. The reforms aim at restoring and growing rail capacity in South Africa, to ultimately reduce trucks on the roads in the medium term and to reset to a more sustainable road/rail freight balance. However, the task at hand is enormous and it will take some years before a notable trend reversal will be evident – see graph 4.

The Air Freight sector has been the star performer among the sub-sectors in 2024, aligning with global trends. According to the International Air Transport Association (IATA), Global Cargo Tonne-Kilometres (CTK) increased by 11.3% in 2024, setting a new record by exceeding 2021’s volumes. Carriers from all regions have seen growth in international traffic in 2024. South Africa was no exception, with the air freight index increasing by a notable 10.5% in 2024, with three of the four underlying components of the index rising strongly. Cargo load on planes increased by a notable 21.9% in 2024, compared to the previous year’s contraction of 2.8%.

After contracting for two consecutive years, the Sea Freight sub-component increased by 3.4% in 2024. According to Transnet National Ports Authority (TNPA), the number of containers handled in 2024 increased by 4.6% compared to 2023, while total cargo handled at ports only increased by a mere 0.3%. The sector remains in urgent need of infrastructure investment to modernize operations in order to improve much needed efficiencies. In that light, Durban Container Terminals (DCT) has recently acquired 20 straddle carriers and nine rubber-tyred gantries to help improve efficiencies at its Pier 1 and 2 terminals, which last year handled 60% of SA’s container traffic.

This expenditure is part of a R3.4bn investment by TNPA earmarked for 2025 to boost equipment and operational efficiencies at its container ports. This sub-sector remains the logistics sector’s Achilles heel, and as such remains high on the agenda for Government’s structural reform efforts.. Among others, the establishment of a Transport Economic Regulator aims to consolidate the regulation of transport sectors and promote competition to improve efficiency. Together with the National Logistics Crisis Committee, it will advance private-sector participation and support investment in logistics, all developments that could have a meaningful impact on the turnaround of the logistics sector in the medium term.

The Storage and Handling sub-sector of the Ctrack Transport and Freight Index declined by 0.2% in 2024, following two years of larger contractions, with inventory indicators generally mixed during the year. Lastly, the transport of liquid fuels via Transnet Pipelines (TPL) declined by 1.8% in 2024 (following on a decline of 1.0% in 2023), reflecting lower fuel demand in the economy. Especially demand for diesel fell sharply during the past two years, partly due to load-shedding reprieve.

The Ctrack TFI signals that transport sector likely subtracted from Q4 2024 GDP

The broad-based weakness evident in the Ctrack TFI in the last few months of 2024 strongly suggests that the transport sector will likely again be a negative contributor to overall GDP in Q4. The transport & communication sector has been a significant under-performer in the broader economy in each of the first three quarters of 2024, a disappointing performance indeed.

“The ongoing weakness evident in the critical logistics sector remains concerning and makes it even more important that infrastructure backlogs be addressed, especially at ports, and that structural reforms be pushed forward to reduce the drag on the economy, while starting to lift South Africa’s potential GDP growth rate. The firm focus on the need for private sector involvement that has now become a government narrative, is to be welcomed. However, structural reform is a lengthy process, and change does not happen overnight,” says Hein Jordt, Chief Executive Officer of Ctrack.

For more information or further insights on the Ctrack Transport and Freight Index, feel free to reach out to us at moc.kcartc@edeernav.saalocin or visit our website at www.ctrack.com. Your journey towards a more informed and resilient transport and logistics operation begins with Ctrack. For past editions, visit: https://ctrack.com/transport-and-freight-index/.

The Ctrack Transport and Freight Index is published on a quarterly basis to provide insights into key industry trends and performance metrics. The next edition is scheduled for the end of May 2025.